Tata Steel, SAIL, Other Steel Stocks Rise Up To 7% As DGTR Recommends 12% Safeguard Duty – News18

Last Updated:

Steel company shares, including those of NMDC Steel and SAIL, rose as much as 7% in early trading on the BSE

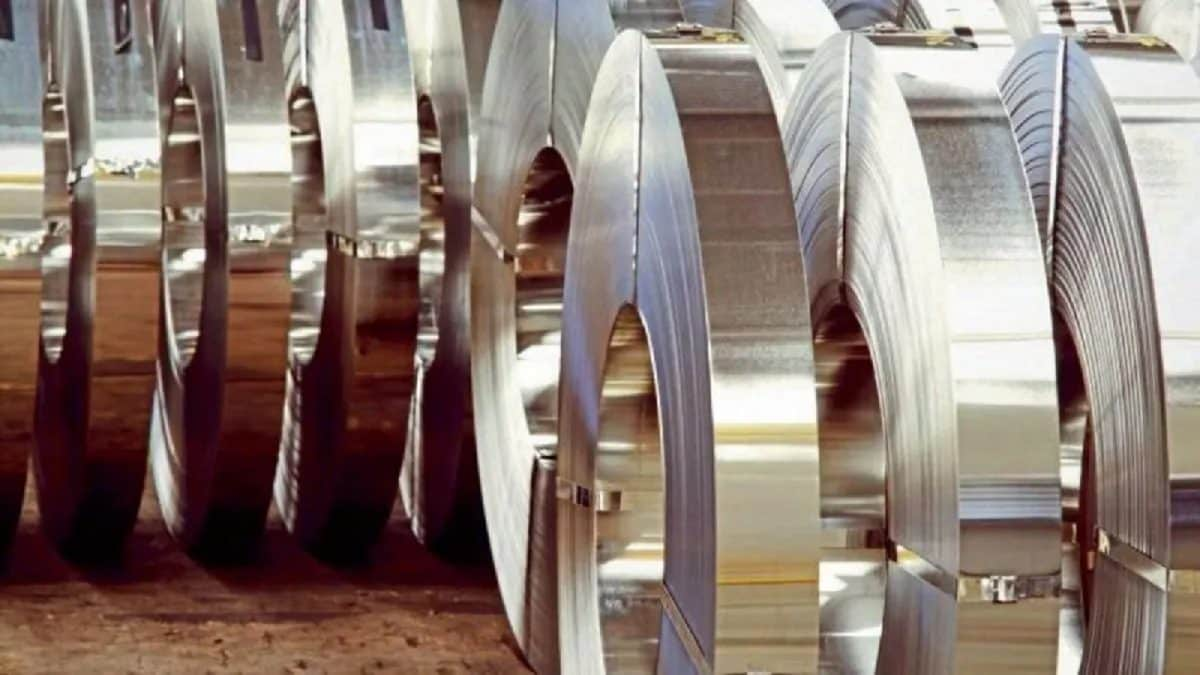

Metal Stock Updates today: Tata Steel, SAIL, Other Steel Stocks Rise Up To 7% As DGTR Recommends 12% Safeguard Duty

Steel Stocks Updates: Steel company shares, including those of NMDC Steel and SAIL, rose as much as 7% in early trading on the BSE on Wednesday, March 19, following the Directorate General of Trade Remedies (DGTR) recommendation to impose a 12% safeguard duty on imports of certain steel products.

NMDC Steel saw the largest gain, jumping 7% to reach an intraday high of Rs 35.97, while SAIL rose 5% to Rs 114.40. Other steel stocks, such as JSW Steel, Tata Steel, Jindal Steel & Power, and APL Apollo, experienced gains of 2-3%.

However, the safeguard duty will need to be formally notified by the Finance Ministry before implementation.

The DGTR has invited feedback on its findings within the next 30 days, after which an oral hearing will be held before making a final decision, according to the notice.

The government initiated an investigation into the need for a safeguard duty or temporary tax on steel imports in December of last year. India, the world’s second-largest producer of crude steel, saw its highest-ever finished steel imports during the April-January period, turning into a net importer, as reported by Reuters. Imports from China, South Korea, and Japan reached a record high in the first 10 months of the fiscal year.

Global brokerage JP Morgan, in its latest steel market note, welcomed the long-awaited safeguard duty announcement, viewing it as a positive move for Indian steel. The duty could increase import costs by Rs 5,500 per ton, though domestic Hot Rolled Coil (HRC) prices may rise by only Rs 2,000 per ton (4%), depending on demand and restocking.

JP Morgan anticipates a full flow-through to EBITDA and expects possible upward revisions for FY26 estimates. However, the extent of improvement is uncertain.

Steel stocks have been on an upward trajectory recently, driven by optimism over China’s steel output cuts, Germany’s infrastructure fund announcement, and the anticipated safeguard duty. JP Morgan expects stock prices to respond positively, as the development signals increased potential for profitability improvement and demonstrates the government’s strong commitment to supporting the steel sector.

The brokerage favors Tata Steel and JSW Steel, with the expectation that SAIL will see a sharp positive stock price reaction due to its recent underperformance.

Emkay Global, another brokerage, believes that investors are optimistic about a mid-cycle recovery, despite the current downturn. The brokerage holds a neutral-to-positive view on the sector, recommending a “selective picking” approach rather than a broad investment.

Emkay has a ‘Buy’ rating on Tata Steel with a price target of Rs 185 per share, while it holds a ‘Reduce’ rating on Jindal Steel & Power, with a price target of Rs 825. It recommends ‘Add’ for JSW Steel and SAIL, with target prices of Rs 1,100 and Rs 120, respectively.

In its note, Emkay highlighted a preference for non-ferrous stocks over ferrous ones, citing strong upcycle aluminum prices, which are boosting earnings and margins for non-ferrous companies. In comparison, ferrous stocks’ valuations already reflect an expected earnings recovery. Non-ferrous valuations remain attractive in light of the favorable upcycle.

Emkay’s top picks include NACL Industries, Vedanta, Tata Steel, Coal India, and JSTL.

Before the safeguard duty announcement, CLSA released a note on metals. The brokerage noted that the metals demand outlook had improved, buoyed by expectations of Chinese stimulus measures and increased European demand driven by infrastructure and defense spending. Additionally, capacity cuts in China are seen as a potential benefit.

CLSA remains more optimistic about non-ferrous metals, favoring Hindalco and Vedanta, while cautioning that a U.S. recession could dampen demand.

For JSW Steel, CLSA raised its price target to Rs 825, while increasing Tata Steel’s target to Rs 145. The brokerage stated that, assuming a 12% safeguard duty, the impact on fair value would be higher for JSW Steel (+7%) and Tata Steel (+10%) due to their greater exposure to flat products, while the effect on JSPL would be more limited (+3%).