C.E.O.s Look Beyond a Rosy Inflation Report

The cloud behind the inflation silver lining

Even upbeat economic news can offer little comfort to markets and the C-suite.

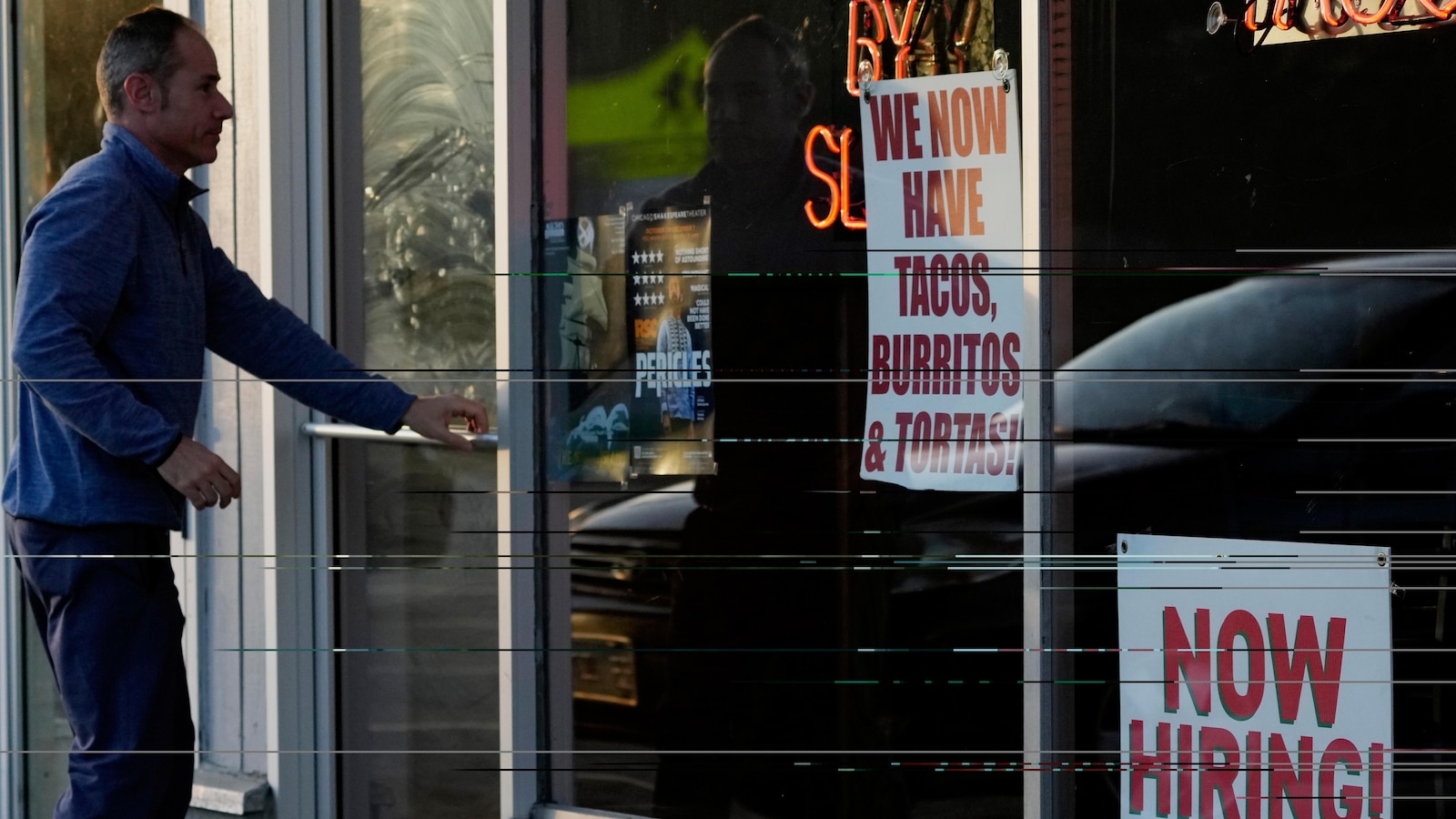

Stocks look set to open lower as relief over Wednesday’s better-than-expected inflation report fades, and concerns grow that a trade war could sap consumer spending and corporate profits. That’s led more corporate chiefs to speak out about the confusion over President Trump’s trade moves.

A recap: The Consumer Price Index showed that inflation cooled off slightly last month. Trump hailed the data as “very good news,” and stocks rallied at the outset.

But others saw red flags, and the S&P 500 pared its gains as the president reiterated his intention to enforce more, and potentially higher, tariffs on trading partners.

The report didn’t fully reflect the effect of the Trump tariffs, let alone the tit-for-tat trade war measures that Canada, China and the European Union are now imposing on the United States. The report was “not as encouraging as it looks,” Thomas Ryan, an economist at Capital Economics, told The Wall Street Journal.

For example, the data showed an uptick in apparel and home furnishings prices, Stephen Juneau, an economist at Bank of America, wrote in a research note on Wednesday. As for tech goods, especially those made in China, Juneau wrote that he expected to see price increases over the coming months. A big concern: Consumer spending, which has helped the United States avert recession, is showing signs of faltering across income brackets.

Egg prices, an emerging symbol of America’s affordability crisis, jumped 10.4 percent last month after a big rise in January, prompting strong words from Senator Elizabeth Warren, Democrat of Massachusetts, about households’ shrinking budgets: “President Trump should focus on lowering costs for families like he promised, instead of causing chaos,” she said in a statement.

Companies are bracing for additional tariff disruption. Novo Nordisk is looking to move more production stateside to avoid being hit by levies, while Boeing is trying to shore up its global supply chain to keep costs down. Separately, food industry lobbyists still hope to win exemptions.

More prominent C.E.O.s are publicly, and diplomatically, offering their thoughts on the trade war:

-

“Uncertainty is not a good thing” for companies, Jamie Dimon of JPMorgan Chase said on Wednesday.

-

David Solomon of Goldman Sachs said that companies understood what Trump was trying to accomplish. Still, he made a public appeal for more “certainty.”

-

Steve Schwarzman of Blackstone spoke of an increase in domestic manufacturing spurred by tariffs. Given the size of the U.S. economy, such a development “tends to be a good thing for the world.”

The latest inflation data is scrambling the thinking on interest rate cuts. The futures market on Thursday was pricing in roughly two cuts this year, but Wall Street is divided. “The data are further evidence that inflation has stalled, reinforcing our view that the Fed will remain on hold this year,” Juneau wrote.

Another test is coming on Thursday: New Producer Price Index data is expected to be released at 8:30 a.m. Eastern.

HERE’S WHAT’S HAPPENING

The government faces a potential shutdown. Though the Republican-led House passed a government funding bill on Tuesday, the legislation has stalled in the Senate, where Republicans need some Democratic votes to overcome any filibuster. Senator Chuck Schumer of New York, the minority leader and a Democrat, said that his party could not support the legislation over concerns about steep funding cuts and the decimation of the government work force.

Speaking of which: Federal layoff plans are due on Thursday. President Trump has ordered government organizations to present proposals for “initial agency cuts and reductions,” a deadline that Politico reports is being met with dread inside several departments. Despite the already big level of cuts, however, federal spending last month rose to a record $603 billion, up $40 billion year-on-year.

A federal judge blocks Trump’s order punishing the law firm Perkins Coie. Judge Beryl Howell of the U.S. District Court for the District of Columbia criticized the Trump administration over an order that she said most likely violated the Constitution, including by denying Perkins Coie access to federal buildings and stripping it of government contracts, because of the political views of its clients. Lawyers have been a target of Trump’s since he took office: He has sought to punish Covington & Burling for representing Jack Smith, the former special counsel.

Elon Musk’s privately held companies are soaring on the secondary markets. Shares in Tesla may have fallen in recent weeks, but those in SpaceX, Neuralink, the Boring Company and xAI are up more than 45 percent since the election, Bloomberg reports. The biggest gain was by xAI, whose valuation has more than doubled since November to $96 billion.

Intel’s new leader faces stubborn problems

Shares in Intel are up more than 11 percent on Thursday, as investors cheered the arrival of a potential savior for the company. Three months after ousting its C.E.O., the chipmaker has a new leader, a veteran tech executive and investor who has turned companies around before.

But it now falls on Lip-Bu Tan to solve the problem that led to his predecessor’s departure: how to revive the fortunes of the embattled chip giant — and whether that involves large-scale deal-making.

A primer on Tan: He has a long history of investing in semiconductor companies in Silicon Valley via his venture capital firm, Walden International, and also ran Cadence Design Systems, a maker of chip design software.

He was on Intel’s board from 2022 until last year, having resigned after reportedly clashing with the C.E.O. at the time, Pat Gelsinger, over how to fix the company.

Intel’s problems are formidable, including how far behind it is in producing chips for artificial intelligence and smartphones. While Nvidia’s shares have been buffeted by recent market volatility, they are still up 26 percent over the past 12 months; Intel’s, by contrast, are down by more than half.

A slumping business complicated Gelsinger’s plan to fix Intel, which involved building new factories in the United States to help turn the company into a maker of others’ processors as well as a designer of its own. Potential customers like Qualcomm and Tesla had expressed interest in using Intel’s contract-manufacturing operation, but have reportedly reconsidered.

The Trump administration’s pledge to roll back the CHIPS Act, which awarded Intel $8.5 billion to build plants in three states, adds a further wrinkle. (At the same time, Intel is one of America’s few remaining advanced chip manufacturers, at a moment when the semiconductor industry has become a key geopolitical asset.)

What lies ahead? The Trump administration has met with Intel leaders about how to fix its operations, and executives have been weighing potential deals.

One pathway that had been considered was some sort of deal for the contract-manufacturing business. That option may still be on the table: Taiwan Semiconductor Manufacturing Company, the world’s biggest chipmaker, has been studying the idea, and according to Reuters, has pitched companies including Nvidia, Advanced Micro Devices and Broadcom about cooperating in a joint venture to run the operation.

The publication adds, citing unnamed sources, that Intel leadership now isn’t interested in selling the business outright.

No reprieve for Big Tech

Corporate leaders who hoped that a Trump-era Federal Trade Commission would go easier on them are finding yet again that this may not be the case.

The agency is pursuing two potentially significant cases that began under Lina Khan in the Biden administration, one against Amazon and another against Microsoft. It’s the latest sign that tech giants, many of whom have sought to score points with President Trump, will still face tough antitrust scrutiny.

The latest: The F.T.C. intends to continue a lawsuit into potentially “deceptive” subscriptions practices at Amazon Prime. (That came after an agency lawyer initially asked for a delay, citing constrained resources — which drew speculation that it was suffering from Elon Musk’s widespread federal cuts. The lawyer later withdrew the request.)

Amazon still faces a separate lawsuit, set to go to trial next year, that accuses it of operating a monopoly and using price discounts to stifle competition.

“The Trump-Vance F.T.C. will never back down from taking on Big Tech,” Andrew Ferguson, the regulator’s chair, told CNBC on Wednesday in a discussion about the Amazon Prime proceedings.

The F.T.C. had already signaled that it’s focused on some kinds of scrutiny into Big Tech. Ferguson said last month that the regulator would run an inquiry into some of the biggest tech companies over whether they are censoring conservative voices.

He announced on Elon Musk’s X platform at the time that the Trump administration would be “restoring free speech and making sure Americans no longer suffer under the tyranny of Big Tech — PERMANENTLY.”

But the F.T.C. also disappointed some corporate executives in other ways, particularly when it said it would keep in place the merger review guidelines devised under the Biden administration. Many deal makers had hoped that Ferguson and his counterpart at the Justice Department’s antitrust division, Gail Slater, would adopt a lighter touch in reviewing M.&A.

Remember that a lineup of tech moguls, including Meta’s Mark Zuckerberg to Amazon’s Jeff Bezos had prime seats at Trump’s inauguration in January. And several tech companies, including Amazon and Meta, donated to Trump’s inauguration fund. Tech leaders also seem to meet regularly with Trump: Zuckerberg was spotted at the White House on Wednesday, Reuters reported.

THE SPEED READ

Deals

-

Two drugmakers that were hit hard by the opioid crisis, Mallinckrodt Pharmaceuticals and Endo, agreed to combine in a deal that values the two at nearly $7 billion. (Joint news release)

-

In entertainment deal-making: Blackstone is reportedly weighing options for Hello Sunshine, Reese Witherspoon’s production company; and Bill Chisholm, the private equity mogul, is said to have emerged as a bidder for the Boston Celtics. (Reuters, Bloomberg)

Politics, policy and regulation

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com.