Fear of a tariff ‘Trumpcession’ puts pressure on Bank and Fed over interest rates

Monetary policymakers on both sides of the Atlantic will be considering how seriously to take Donald Trump’s threats of an all-out trade war as they give their verdict on the path of interest rates this week.

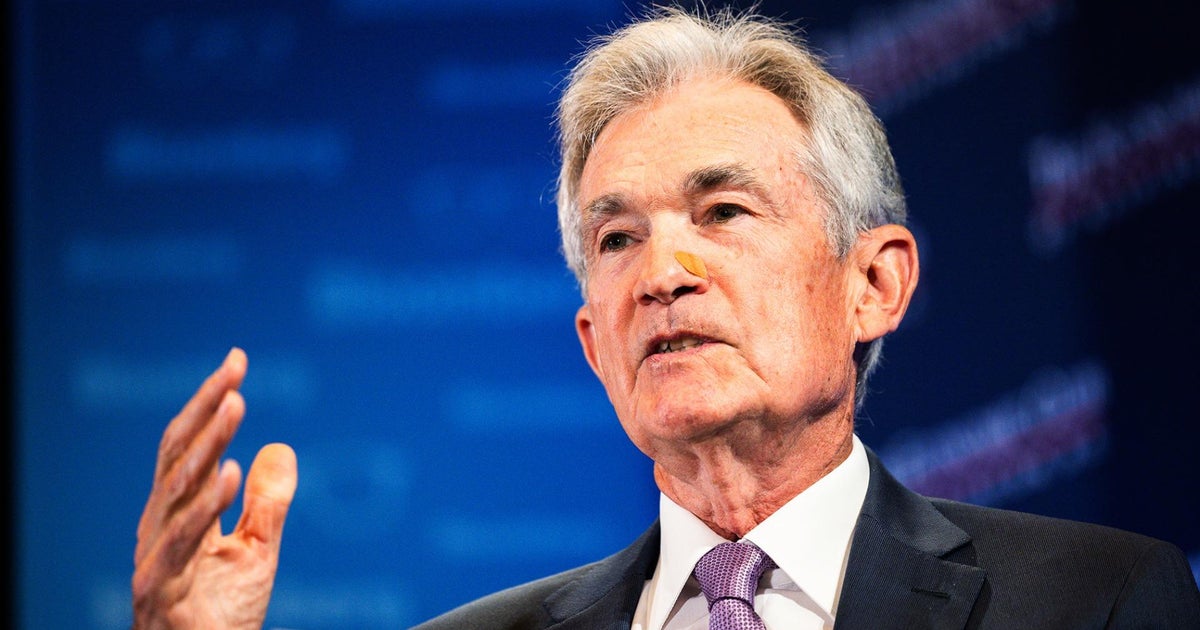

The Federal Reserve, the US central bank, will examine the prospect of a “Trumpcession” brought on by tariffs that send import costs rocketing and convince consumers, already shellshocked from the cost of living crisis, to stop spending.

Consumers are the engine of the US economy and confidence levels plummeted last month, according to the Conference Board’s index of buying intentions, a leading survey. The index covering February registered the biggest monthly decline in nearly four years.

There are growing concerns that the US president does not care how far the stock market may fall while he battles Washington’s major trading partners – and, worse, that he is sanguine about a fall in output which, if it continues, could bring about a full-blown recession.

Nigel Green, an analyst at investment firm deVere, says: “A dangerous mix of inflationary pressures alongside an economic slowdown puts the Fed in a precarious position.”

Yet he insists it is time for to “lead and not lag”, because preventing a severe downturn should be the top priority. “Rate cuts must come sooner rather than later to prevent deeper damage.”

The Fed will announce its latest decision on interest rates on Wednesday, swiftly followed by the Bank of England on Thursday. Policymakers at the Bank face the same dilemma: whether to continue cutting rates or to pause and wait while the tariff drama plays out.

Tariffs are high on the list of worries in Threadneedle Street. In November, the Bank believed inflation was beaten and interest rates were on course to fall well below 4% in 2025. Today, the Bank, like the Fed, is more cautious. The UK rate stands at 4.5%, slightly above the Federal Reserve target rate of between 4.25% and 4.5%.

On the domestic front, the Bank’s situation is also similar to the Fed’s – inflation is rising and remains above a 2% target level while the labour market, especially in the manufacturing and construction sectors, is characterised by rising unemployment, falling vacancies and warnings from employers of layoffs.

Robert Wood, chief UK economist at Pantheon Macroeconomics, says the Bank’s monetary policy committee (MPC) is right to be cautious. “The MPC is finding there is a very difficult trade-off between the figures showing an employment rate that is slowing and an inflation rate that is rising,” he says. “It faces a judgment call that most of the nine members will want to take longer to consider. And it’s reasonable for them to wait until the fog lifts and they can see more clearly what direction the economy is going in.”

Official figures released on Friday showing that the UK economy unexpectedly shrank by 0.1% in January did little to alter the view in financial markets that the Bank will keep rates on hold.

Like most economists, Wood expects the Bank to hold rates on Thursday and only cut again at its meeting in May. A further quarter-point reduction, to 4%, is then expected before the end of the year.

Events are likely to be more dramatic in the US, where consumer spending is more heavily aligned with a downturn in stock market values.

A Fed report last year showed that the strength in retail sales over the last decade has been driven by richer households that have, since the start of 2018, raised spending more than twice as much as the low-income groups, mostly underpinned by gains from the stock market. As Albert Edwards at Société Générale says: “If the equity market now plunges, we might find that it disproportionately hits retail sales more than usual.”

Garry White, an analyst at the stockbroker Charles Stanley, says: “Fears of a ‘Trumpcession’ due to [the president’s] aggressive trade policies mean that markets now expect the Fed will continue to cut interest rates, despite high inflation.”

However, the uncertainty about when tariffs will take effect, and whether that translates into prices, means Wall Street is generally expecting the Fed to delay this week.