Federal Reserve holds rates steady despite economic uncertainty

Getty Images

Getty ImagesThe US central bank has kept interest rates unchanged for the second time in a row, while warning that economic uncertainty had increased.

The decision, which was widely expected, left the Federal Reserve’s benchmark interest rate hovering around 4.3%, where it has stood since December.

Forecasts released by the bank also showed policymakers expect weaker growth and faster price inflation this year than they did just a few months ago.

It comes as concern rises about the effect US President Donald Trump’s tariffs are having on the economy.

Since taking office in January, Trump has announced blitz of new tariffs while also calling for big cuts to taxes, regulation, and government spending.

Economists have warned that some of those policies could cause prices to rise, at least in the short-term, and raise uncertainty for businesses.

Analysts say the concerns have also helped to drive a sell-off in the stock market, with the S&P 500 falling 10% from February back to levels last seen in September.

However, in its rate announcement, the Fed said economic activity had continued to expand at a “solid” pace.

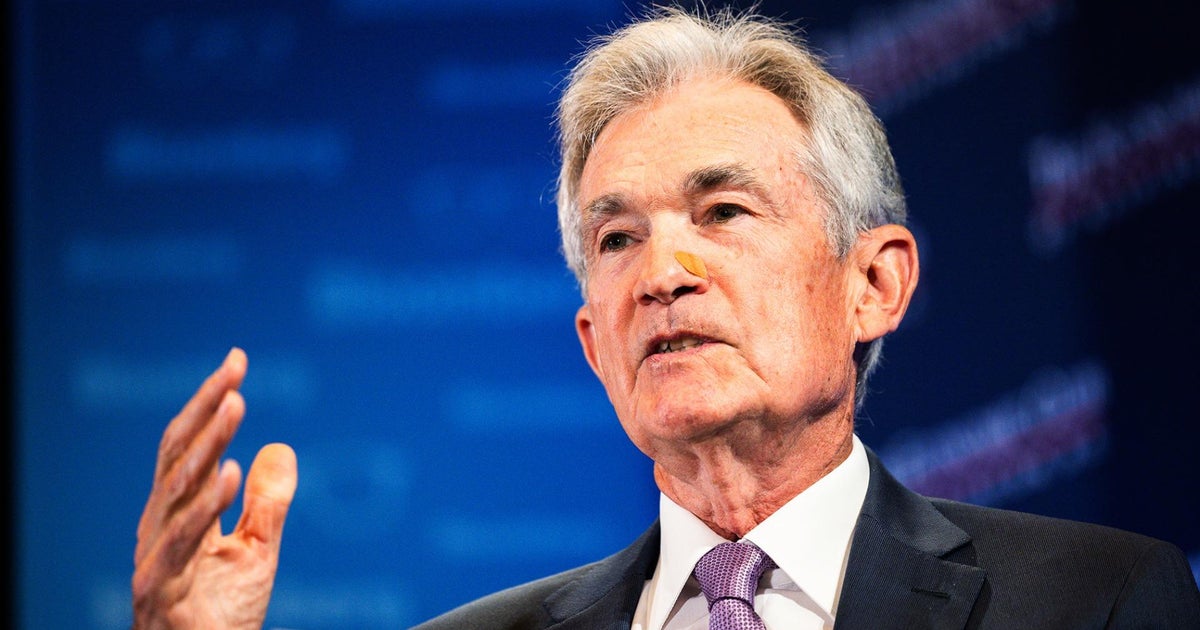

Federal Reserve chairman Jerome Powell has previously said he saw little risk to taking a patient approach, while waiting for more certainty about the impact of White House policies.

But the dynamic has added to the challenge facing the Fed, which has spent much of the last three years trying to keep prices stable and avoid economic downturn.

It hiked borrowing costs significantly starting in 2022, aiming to cool the economy and ease the pressures pushing up prices.

Inflation, the rate of price increases, has since fallen to 2.8% as of February, but remains above the bank’s 2% target.

Recent surveys also suggest that public expectations for inflation have risen, which could make the bank’s job stabilising prices more difficult.

Households expecting prices to rise have incentive to buy now. But that can fuel inflation, as firms respond to the increased demand by raising prices further.

“The problem the US faces is that inflation remains a primary risk and is showing signs of consumer expectations becoming unanchored from the 2% target,” said Lindsay James, investment strategist at Quilter.

“Leading indicators of demand may be slowing in the US, but inflation persists and risks spiralling if the proposed economic policies continue.”

The forecasts showed policymakers now expect inflation to stand at 2.7% at the end of this year, up from the 2.5% they had predicted in December.

They are also expecting growth of just 1.7% this year, down from the 2.1% previously anticipated.

Policymakers are still indicating they expect to cut rates by the end of the year.