How Tariffs on Everything From Aluminum to Barley and Malt Will Impact Beer Pricing

The news from Washington D.C. regarding tariffs — what is impacted, what is not, percentage changes, withdrawals, and double downs — has many people needing a drink. For those reaching for a beer, there’s a problem. That pint is going to get more expensive if these tariffs stick.

Of course, the “if” is the big thing breweries are paying close attention to.

“There’s a lot of uncertainty, and businesses thrive on certainty, on planning,” says Bart Watson the president and CEO of the Brewers Association, a trade group that represents small breweries. “There’s a business challenge overall for our members in this on-again, off-again, maybe this thing, maybe this other thing, situation.”

In some ways, brewers have been through this before. In 2018, during the first Trump administration, a 10% tariff was levied against aluminum, impacting the price of cans for brewing companies and consumers. Those remained in place during the Biden administration.

Shortly into his second non-consecutive term, Trump announced an additional 25% tariff on aluminum. Cans are, by far, the most popular packaging option by small brewers, especially after COVID-19 impacted draught sales at bars.

Beer ingredients may now be at risk

Because of its tactile and ubiquitous nature, cans are easy to cite for impending consumer financial impacts, but brewers are also looking at creeping costs of raw ingredients.

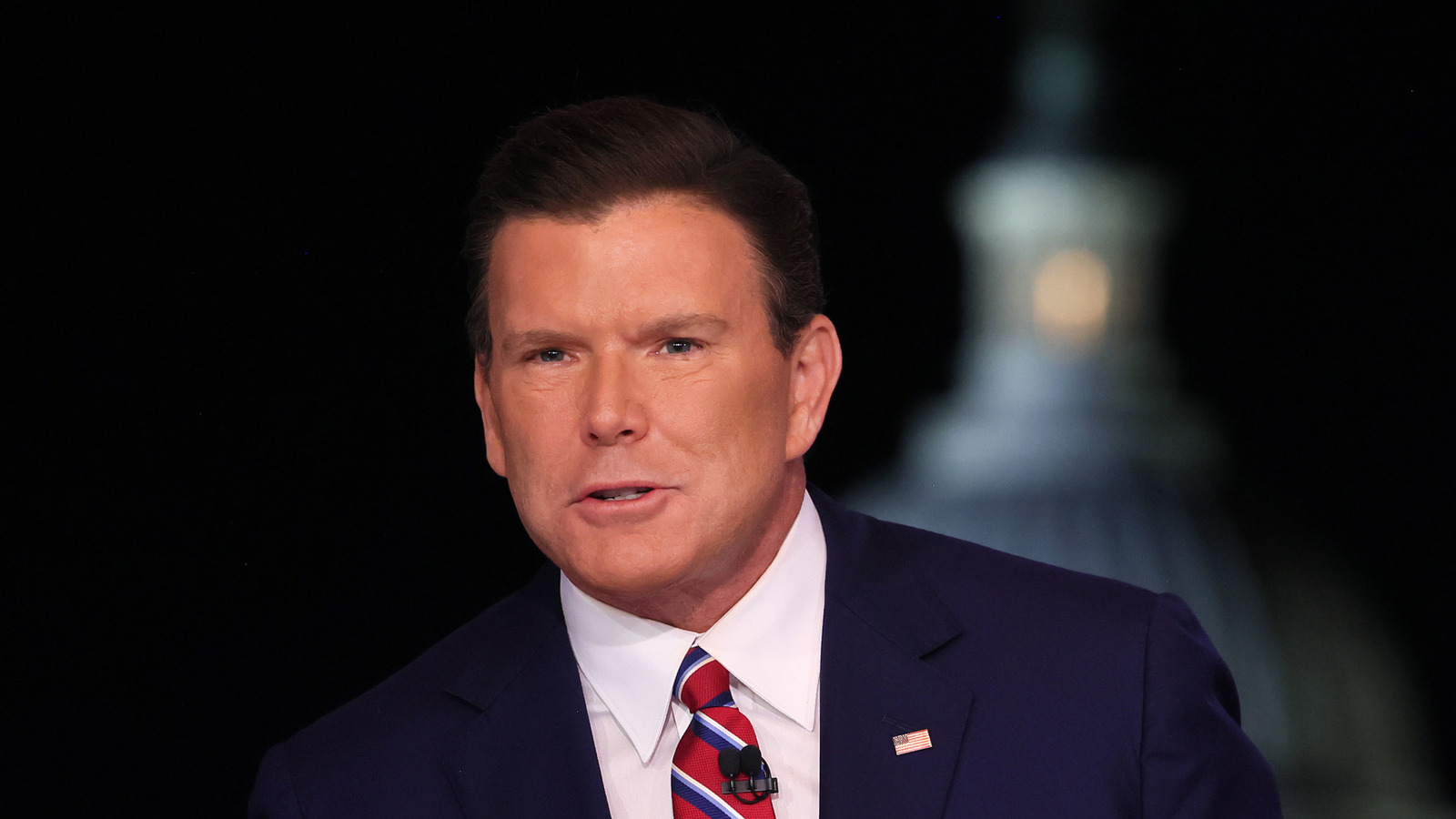

Bart Watson, president and CEO, The Brewers Association

“Overnight tariffs could add $60 million, give or take a little bit, to the cost structure of small brewers in the U.S.”

— Bart Watson, president and CEO, The Brewers Association

“We have a fairly integrated North American barley and malt system,” says Watson. “Because most U.S. barley is contracted by large brewers or for export to Mexico, a lot of craft brewers end up getting malt from Canada.” He notes that the U.S. imported customs value was about $230 million in 2024 and was consistent with that number in prior years.

“Overnight tariffs could add $60 million, give or take a little bit, to the cost structure of small brewers in the U.S.,” says Watson.

This has led some brewers to start looking at other avenues for malt or to increase some European orders, which could also be impacted, based on threats from the administration. Globally, there has also been a strain on the grain market since 2022 when Russia invaded Ukraine.

There are a handful of small maltsters that operate around the country, and many serve the beer community on a manageable scale, but overall lack the acreage or infrastructure to support all brewery needs should the international supply become financially prohibitive.

With more than 10,000 breweries operating in the country, many of them small businesses, the tariff machinations are a reminder that while many pints are local, beer is a global endeavor.

Packaging pain

Still, much of the tariff focus remains on aluminum.

In 2022, the Beer Institute, a trade group that represents larger brewers, commissioned a study by Harbor Aluminum, which it describes as an independent authority on the aluminum industry and its markets.

The study found that when the initial tariffs (known as Section 232) were implemented by Trump, the U.S. beverage industry paid $1.714 billion on 8.203 million metric tons of aluminum between March 23, 2018, and August 31, 2022.

“Of that amount, only $120 million (7%) went to the U.S. Treasury,” the Beer Institute notes in a press release. “Harbor Aluminum estimates U.S. rolling mills, U.S. smelters, and Canadian smelters received $1.594 billion (93%) of the total by charging end-users, such as U.S. brewers, a tariff-burdened price regardless of whether the metal was meant to be tariffed based on its content or origin.”

It notes that in 2020, “brewers bought more than 41 billion aluminum cans and bottles, making aluminum the single largest input cost in American beer manufacturing.”

Devastation in exported beers

Watson says Canada is the biggest export market for American craft beer. As Trump has batted about tariff threats, Canadian importers and retailers have reacted by taking American products off shelves or canceling orders.

“I never thought I would be talking the same way as the Jack Daniels CEO, but he has been on the record saying recently the removal of product is probably even a bigger concern than any sort of retaliatory tariffs, and that’s what we’re seeing for our members,” says Watson.

He believes that stance could linger longer than any of the immediate or long-term tariff impacts.

This has been true for Milwaukee’s Lakefront Brewery where co-founder and president Russ Klisch says that earlier this month, purchase orders from Canadian importers were canceled.

“Right before this all started, we had our gluten-free IPA approved by the Liquor Control Board of Ontario, to be taken province-wide, in their government stores, and that was really great news for us,” says Klisch. “It was also going out to British Columbia and the western provinces.”

He said the brewery, founded in 1987, was excited by the deal and the increase it would mean for production.

“That, of course, got squashed with this tariff situation,” says Klisch. “We’re now sitting on some beer in the tanks and a lot of packaging not knowing if it is going to be used or not.”

Ultimately, these tariffs are causing headaches and worry for small brewers. Many are asking themselves if they should be stocking up on cans or buying excess malt. Those questions are also dependent on storage space. Most are simply wishing for clarity and stability so they can put their money into other aspects of the business, like growth, hiring, and innovation.

“It’s just the uncertainty right now where you really can’t plan or you can’t go ahead,” says Klisch.