Martin Lewis gives verdict on spring statement as ISA reforms underway

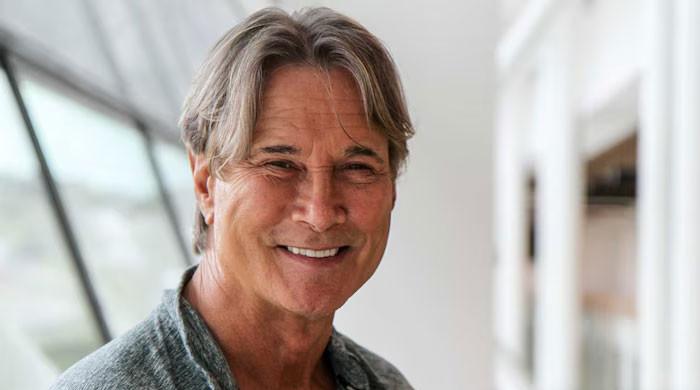

Martin Lewis has given his take on Labour’s spring statement, questioning Rachel Reeves’ claim about how much “better off” families are set to be in the near future.

Writing on X, the money expert called into question the chancellor’s claim that real household disposable income is set to rise £500 under this Labour government. The reality is “not that rosy” he said, pointing to a contradictory explanation in the Office for Budget Responsibility’s (OBR) corresponding economic report.

The reason for this is because the £500 figure is “over the life of parliament not per year,” he explains.

According to the OBR’s report, household income is expected to see ‘almost no growth in 2027/28’ after a sharp rise which began in 2022/23. This will pick up in 2028 to 2030, the watchdog forecasts, due to factors like the freeze on income tax thresholds ending and real wage growth increasing.

The report also finds that the welfare cuts announced by Labour last week will plunge 250,000 people into poverty, including 50,000 children.

Giving his view on this analysis, Mr Lewis points out that “most of [the growth] comes in the last two years, after drops first, and is based on assumptions that some of current tax proposals eg freezing tax thresholds will end.”

This income tax threshold freeze has long been criticised as a way for the Treasury to boost revenue from income tax without increasing its rates. Since 2021, the personal allowance has been frozen at £12,570. This is the amount that can be paid before income tax deductions begin.

The effect of this is what economists call “fiscal drag,” where more people are pulled into higher tax brackets as their earnings increase, but the thresholds stay the same.

In 2022, then-chancellor Jeremy Hunt extended the end date of the freeze from April 2026 to April 2028. Rachel Reeves confirmed Labour would maintain this end date at her October Budget in 2024.

The money expert also shared the latest update on the rumoured changes to cash ISAs, as the OBR’s report confirmed that they were still being looked at by the Treasury.

The watchdog writes that the government is still “looking at options for reforms to Individual Savings Accounts that get the balance right between cash and equities to earn better returns for savers, boost the culture of retail investment, and support the growth mission.

“Alongside this, the government is working closely with the Financial Conduct Authority to deliver a system of targeted support to give people the confidence to invest.”

Earlier in March, it was reported that the Treasury was planning to push ahead with changes to Cash ISAs that could see the yearly tax-free allowance for them greatly reduced. The plans are being looked at with the aim of encouraging more people to choose to save in Stocks and Shares ISAs, boosting the investment culture in the UK.