No cash Isa shake-up in spring statement, but Reeves still considering cuts

A mooted shake-up of cash Isas will not be announced in the spring statement this month, but the government is still considering the possibility of cutting the maximum amount people can put into them, it has emerged.

In recent weeks a row has broken out over whether ministers should scale back tax breaks on the popular savings accounts to help encourage a shift from cash into stock market-based investments.

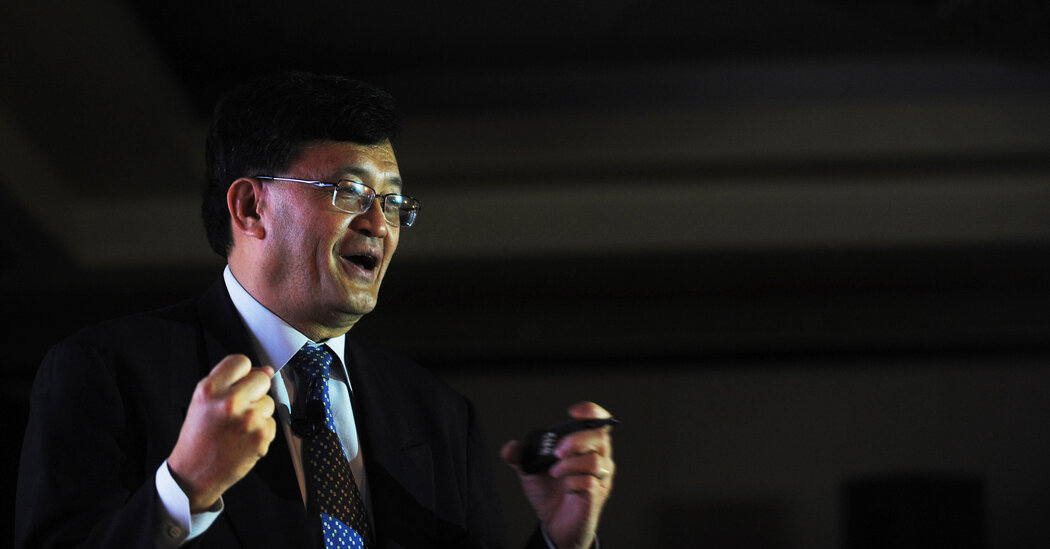

The chancellor, Rachel Reeves, has hopes to strike a “balance” between money put into cash and shares, and there has been speculation that she could announce a shake-up in the spring statement on 26 March.

However, it is understood that no changes to cash Isas will be announced that day.

Officials suggested the shake-up is a longer-term move, which may mean any reforms will have to wait until at least this autumn’s budget.

The government is being lobbied by some fund managers to put more focus on the riskier practice of investing in the stock market as a way of boosting UK economic growth.

Senior City executives met Reeves and ministers, to discuss proposals to possibly slash the cash Isa allowance from the current £20,000 a year to £4,000. Some executives have suggested scrapping the stand-alone cash Isa and having a single account for both cash and equities.

Tax-free Isas were introduced in 1999 and the main two types are the cash Isa and the stocks and shares Isa. More than 18 million people have a cash Isa, and there is almost £300bn sitting in them. The move to delay any reform was first reported by the Financial Times.

Last month, Reeves said: “We want to get that balance right. I do want to create more of a culture in the UK of retail investing like you have in the United States.”

Some investment firms have released data that they said showed UK savers were “paying the price” for playing it safe because putting money into the stock market could generate much higher returns.

However, building societies and other savings institutions have pledged to fight any attempts to downgrade cash Isas. Last month, the Building Societies Association called on the government to “save” cash Isas, saying it would continue to press the chancellor “to listen to all sides of the cash Isa argument, not just to the loud voices of a group of self-interested big businesses”.

Britain’s biggest building society, Nationwide, has said the accounts “not only help ordinary people save efficiently but enable us to fund our first-time buyer lending”.

Meanwhile, Martin Lewis, the founder of MoneySavingExpert.com, who opposes reducing the cash Isa limit, recently told a committee of MPs that people had told him “they are worried about what’s going on” amid the uncertainty over the future of cash Isas.