Stocks making the biggest moves midday: Nvidia, Intel, PepsiCo, Tesla and more

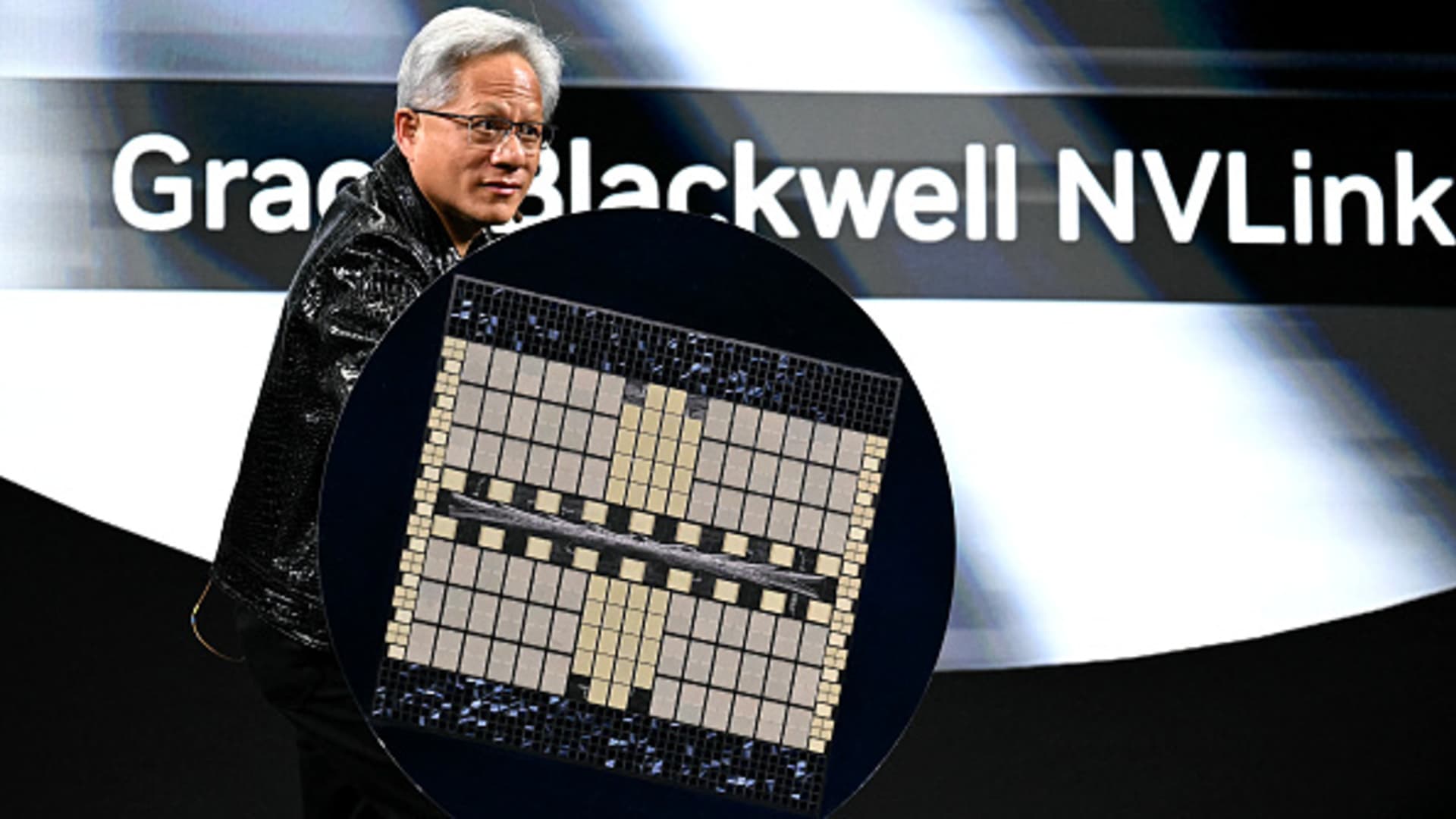

Check out the companies making headlines in midday trading. Nvidia — Stock in the chipmaker surged more than 6%, reversing course after several weak sessions. Shares slumped roughly 8% in March and are down 14% in 2025. Target — Stock in the retailer slipped about 3%, as the broader field of consumer defensive stocks took a leg lower on Wednesday. Peer retailer Walmart declined almost 2%. Crocs — The shoemaker advanced 3% on the back of Loop Capital’s upgrade to buy from hold. Loop said the stock has an attractive valuation, which provides an entry point for investors, amid recent market volatility that’s been tied to tariff uncertainty. Sunrun — Shares of the residential solar energy tumbled about 7%. Jefferies downgraded the stock to hold from a buy rating, citing the lack of recovery in the solar energy sector, in addition to ongoing uncertainty surrounding the Inflation Reduction Act. Groupon — Shares advanced more than 39% after Groupon’s full-year revenue outlook surpassed Wall Street’s forecast. The online marketplace company expects revenue in the range of $493 million to $500 million, while analysts polled by FactSet were looking for $491.5 million. Novo Nordisk — Stock in the Danish pharmaceutical company pulled back more than 4%. Shares are down more than 14% so far this week, on the heels of fresh data that showed lukewarm results for its weight loss drug CagriSema on Monday. Intel — Shares jumped more than 3% after Reuters, citing four sources familiar with the matter, reported that TSMC has raised a joint venture proposal to U.S. chipmakers Nvidia, Advanced Micro Devices and Broadcom to run the operations of Intel’s foundry division. Nvidia, AMD and Broadcom were also higher during the session. Tesla — Shares of the Elon Musk-helmed electric vehicle company were about 7% higher on Wednesday. On Tuesday, President Donald Trump said he planned to buy a Tesla , while Morgan Stanley’s told investors to buy shares on the pullback. Tesla stock recorded its worst session since 2020 on Monday, and shares are down about 40% year to date. Myriad Genetics — Shares added 7% after Piper Sandler upgraded the genetic testing firm to overweight, with analyst David Westenberg noting the company’s new CEO can serve as a reset for the business. PepsiCo — Stock in the soda company ticked down almost 3% after a downgrade to hold at Jefferies. The firm said Pepsi’s stock has limited growth ahead due to its struggling U.S. beverage business as well as its snack unit. HubSpot — Stock in marketing and customer service company gained 3% on the heels of a Barclays upgrade to overweight. The firm cited artificial intelligence as a catalyst for new monetization opportunities. — CNBC’s Hakyung Kim, Sean Conlon and Alex Harring contributed reporting