Trump says he’s planning more tariffs on April 2, calling it “liberation day.” Here’s what it means.

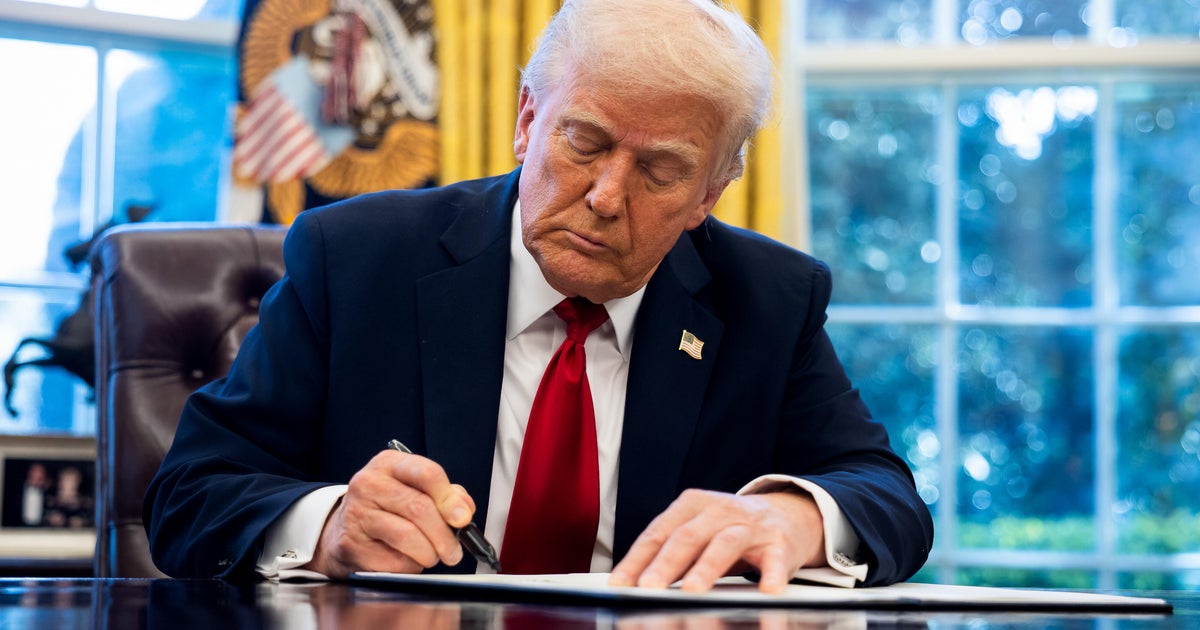

The Trump administration is planning to impose a round of fresh tariffs on April 2, a day President Trump has dubbed “liberation day.” The announcement is viewed by economists as the culmination of his “America First Trade Policy,” an executive order he signed on his first day in office aimed at revitalizing U.S. manufacturing.

Mr. Trump has referred to his April 2 tariff announcement as “the big one,” suggesting that the plans may be more far reaching than the import levies he’s already unleashed on goods from other nations, such as his March 26 declaration of 25% tariffs on vehicles and auto parts imported into the U.S.

“For DECADES we have been ripped off and abused by every nation in the World, both friend and foe. Now it is finally time for the Good Ol’ USA to get some of that MONEY, and RESPECT, BACK. GOD BLESS AMERICA!!!” Trump said about his April 2 plans in a post earlier this month on Truth Social.

On April 2, Mr. Trump is expected to announce his administration’s plans for so-called reciprocal tariffs, which he deems necessary to erase trade imbalances with nations that export more goods to the U.S. than they import from America. But the addition of broad-based tariffs to a host of imports is likely to heat up a global trade war that could, at least in the short term, boost prices for U.S. consumers and juice inflation.

“Tariffs are a tax on imported goods, and research shows that that majority gets passed along to consumers,” Colin Grabow, associate director of the Herbert A. Stiefel Center for trade policy studies at the Cato Institute, a libertarian think tank, told CBS MoneyWatch.

Ultimately, the Trump administration’s goal is to increase prices on imports to the point where it’s economically favorable for companies to relocate their manufacturing to the U.S., he noted.

“If prices don’t go up, it doesn’t deter imports, and therefore there is no reason to set up shop in the U.S.,” Grabow explained. “Part of the logic is premised on prices going up, otherwise they are not going to accomplish their goal.”

Economists say that Mr. Trump’s tariff agenda, including the uncertainty surrounding it, could drag down U.S. GDP by depressing financial markets and consumer sentiment.

“The main channel from trade policy uncertainty to GDP is via business investment. Under higher trade policy uncertainty, future revenue streams of an investment become more uncertain, raising the option value of delaying investment decisions until the situation is clearer,” Oxford Economics analysts said in a research note.

What tariffs will Trump announce April 2?

Mr. Trump teased his April 2 announcement on Wednesday when he announced his new 25% tariffs on foreign-made cars and auto parts. “That’s Liberation Day, that’s gonna be on the 2nd, and that’s gonna be reciprocal, and I think people will be impressed,” the president said.

Reciprocal tariffs are designed to match the import duties placed on U.S. goods and services by other nations, as well as compensate for other trade barriers, according to the Yale Budget Lab, a non-partisan public policy think tank. According to a White House memo from Feb. 13, the U.S. faces additional trade barriers aside from tariffs such as regulatory requirements that can make it more difficult for American exports to reach other nations.

While the size and scope of the reciprocal tariffs that Mr. Trump plans to announce are unknown, Treasury Secretary Scott Bessent last week said the administration’s reciprocal tariffs would target countries with the biggest trade surpluses, as well as those which have imposed the highest tariffs plus non-tariff trade barriers on U.S. goods.

Multiple nations run large annual trade surpluses with the U.S., including Germany, Ireland and Italy in the European Union, as well as Vietnam, Japan and Taiwan. The U.S. also has a large trade deficit with China, although Mr. Trump has already imposed new tariffs on that nation.

“It’ll be in many cases less than the tariff that they’ve been charging us for decades … I think we’re trying to keep it somewhat conservative,” Mr. Trump said on March 26.

Mr. Trump added that he’ll introduce a reciprocal tariff policy on “all countries,” which he said would be “very lenient.”

Meanwhile, additional tariffs are also slated to go into effect on April 2, with Mr. Trump’s one-month delay on 25% tariffs on Canadian and Mexican imports set to expire that day. The 25% auto tariff announced by the president on March 26 is also scheduled to take effect on April 2.

What are reciprocal tariffs?

Reciprocal tariffs enacted by the U.S. would match foreign nations’ levies and other trade policies on American goods.

A reciprocal tariff policy would include calculating a country-specific number that the Trump administration deems representative of all trade barriers. But import restrictions other than tariffs, such as regulatory requirements, could be hard to quantify, economists say.

“There are a lot of intangibles, like testing regulations for different products in countries, or perceived openness to business with American companies,” Simon Macadam, deputy chief global economist at Capital Economics, told CBS MoneyWatch. “These are things you can’t easily put a number on.”

Because of this complexity, some experts expect Trump’s reciprocal tariffs could be more limited in scope, and might not be truly “reciprocal” because they may not exactly match other countries’ levies.

“We shouldn’t be surprised if some of the stuff is rolled back, or not as sweeping as maybe originally talked about, because logistically, from a practical perspective, running the calculations and coming up with a number is extremely time consuming,” Grabow of the Cato Institute said.

Wilbur Ross, who served as the U.S. Secretary of Commerce during the first Trump administration, agreed that a truly reciprocal tariff policy would be “very complicated to get to work.”

“If you were literally going to be reciprocal, you would put the same tariff on a product that comes into the U.S. as that country charges on products from the U.S.,” he said. “But the problem is you’d be charging a different tariff on the same item from different countries.”

That would create loopholes for exporters to ship products through lower-tariffed countries to the U.S., Ross added. “It would make it easy for people to game the system,” he said.

What does Trump want to achieve?

Through his “Fair and Reciprocal Plan” on trade, Mr. Trump is aiming to bring about three outcomes: Boost U.S. manufacturing jobs; close the $1.2 trillion U.S. trade deficit; and gain leverage over U.S. trade partners.

But experts say that trade barriers such as tariffs may not be enough to revitalize U.S. manufacturing jobs, which have fallen sharply over the last few decades. Fewer than 13 million people are employed in manufacturing today, down from a peak of 19.6 million in 1979, according to federal data.

“To a large extent, and particularly in low- and medium-tech industries, the economics of production will not be significantly altered by a 10-20% tariff,” Macadam said. “When labor costs in hubs like Mexico are one-fifth of what they are in the U.S., in order to induce companies to seriously relocate a lot of production back to the U.S. a 20% tariff isn’t going to cut it.”

There’s also the unknown of how long any new tariffs announced by Mr. Trump will remain in place. Such uncertainty could deter American or foreign businesses from investing heavily in re-shoring manufacturing to the U.S.

“Even if for some companies it gets to the point where it seems to make financial sense to move back to the U.S., there’s the question of, ‘Are these tariffs actually going to last a long time?'” Macadam said. “If you think the tariff is going to be there forever, then yeah, absolutely relocate. But if it’s reversed or rates are lowered, then it would have been silly to relocate.”

What will tariffs mean for consumers?

Consumers typically pay the price for tariffs, as companies have said they plan on passing off much of the costs to their customers.

As a result, a round of fresh tariffs could boost inflation, economists say. According to an analysis by Oxford Economics, if the effective tariff rate on imports into the U.S. rises from their 2024 level of 2.5% to 10% in April, which is what Oxford Economics expects, prices in aggregate would rise by half a percentage point.

“Inflation was on trend to fall — now we expect it to rise,” Michael Pearce, senior U.S. economist at Oxford Economics, told CBS MoneyWatch.