What new UK rules on pension inheritance may mean for you

How will the new rules work?

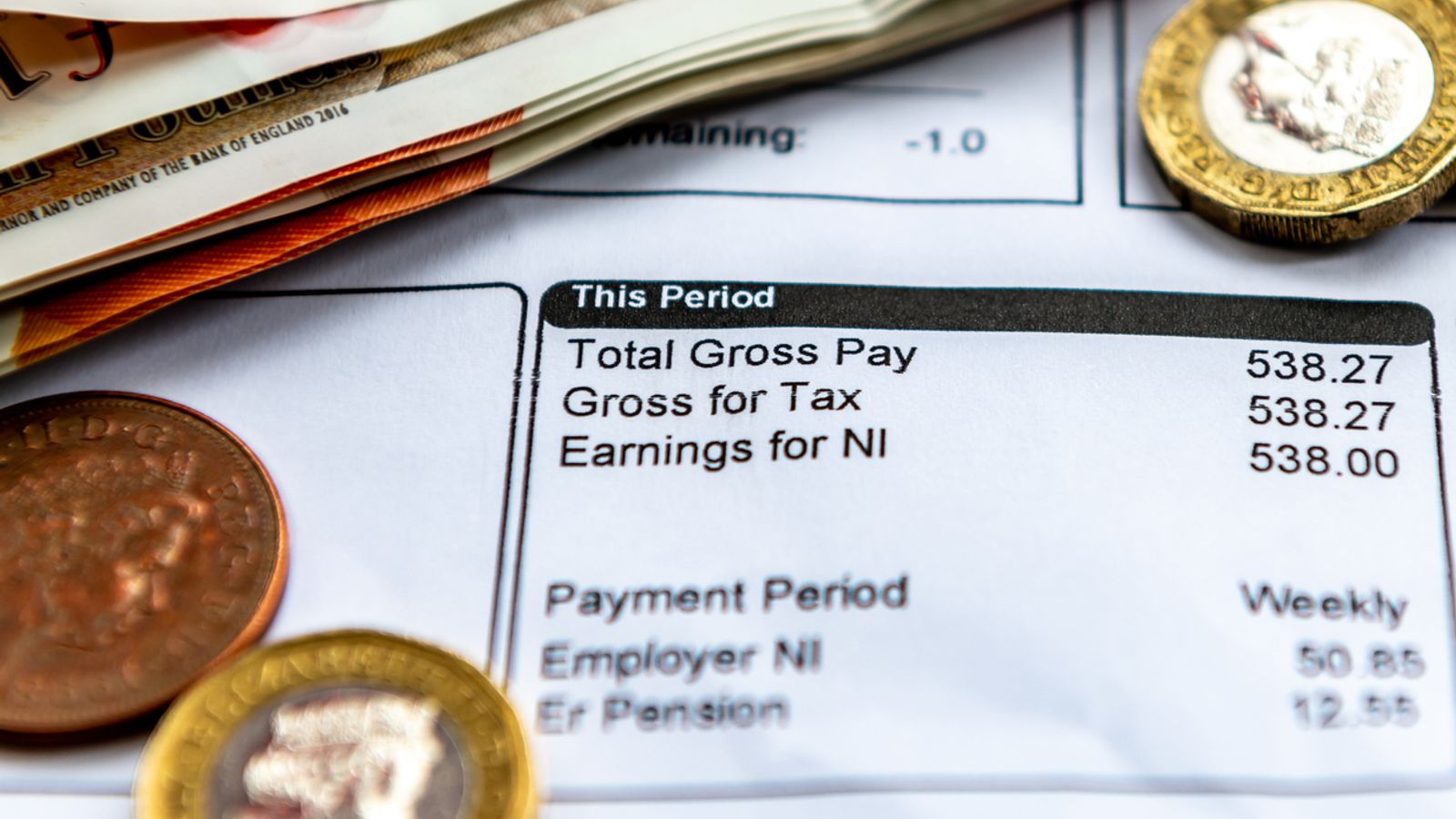

At the moment, pensions tend to be outside people’s estates for inheritance tax (IHT) purposes. But last autumn Rachel Reeves announced that money left in a defined contribution (AKA money purchase) pension after your death will be pulled into the IHT net from April 2027.

Most workplace pensions and all private pensions are defined contribution.

The changes mean that “unused” pension savings could be taxed as part of someone’s estate if they exceed the IHT threshold.

Unused funds are money in a pension pot that hasn’t been used to claim an income, such as buying an annuity, explains The People’s Pension, a provider.

IHT is a tax paid on someone’s assets after they die if they leave enough to go above a certain threshold. The standard IHT rate is 40%, and it is charged only on the part of the estate that is above the tax-free threshold, which is £325,000. (There is a separate threshold for homes.)

The exemption for spouses or civil partners will continue to apply, so everything can be left to them without an IHT bill. But other beneficiaries could face tax.

Crucially, the details of how all this will work in practice have not been finalised yet.

How many people are affected by this?

The government insists that the vast majority of people won’t be affected.

Late last year it estimated that of about 213,000 estates with “inheritable pension wealth” in 2027-28, 10,500 (just under 5%) would face an IHT bill for the first time because of the changes, and about 38,500 estates would pay more IHT than would previously have been the case. But the government said these figures did not take into account “potential behavioural changes”, such as people drawing down pension funds at a faster rate.

The pension firm Royal London says: “If you own your own home, then when your defined contribution pension is added on to this, it might be more than the amount you’re able to pass on free of IHT. And that could mean IHT has to be paid when you die, or when your husband or wife dies.”

What can I do now?

For older people who can afford it, the easiest thing is probably to spend more pension cash now. But everyone’s circumstances are different, and it is vital for people to ensure that they have enough money to support them through the later years of their retirement.

“Faced with the prospect of seeing their hard-earned pension funds heavily taxed after their death, many older individuals are considering a different approach: spending more of their pension while they are alive,” Anick Sharma, a financial planner at Videre Financial Planning, says, adding: “The reasoning is simple – why leave behind wealth that will be significantly eroded by tax when it could be enjoyed in the present?”

He says that, for many, the reality is that by the time their estate is passed down, their children are likely to be financially independent and have no pressing need for the inheritance.

Some people are planning to give their children money to help with things such as buying a first home.

One way of accessing your pension is to take out an annuity, a product that gives you a guaranteed retirement income. So we are likely to see strong demand for annuities in future.

We may also see more older people who are worried about a possible future IHT bill take out equity release mortgages. These are a way for over-55s to get cash out of their property without the need to move home. Doing this reduces the value of your estate.

Some will go further and use this as an opportunity to downsize their home, reckons Andrew Oxlade, an investment director at Fidelity International. “Money could be raised, some of which could be handed to children and grandchildren. The seven-year rule [see later] is crucial to this … Given the challenge faced by gen Z on getting on the property ladder, it’s an option many parents might consider.”

There are various allowances people can use to give tax-free gifts. For example, you can give away assets or cash up to £3,000 in a tax year without them being added to the value of your estate. That £3,000 can be given to one person or split between several people. The small gift allowance lets you give as many gifts of up to £250 per person as you want each tax year, as long as you haven’t used another allowance on the same person. There’s also an allowance that lets you give tax-free gifts to people getting married.

Meanwhile, the “potentially exempt transfer” rules allow you to give money or gifts of any amount or value to anyone, which will become exempt from IHT as long as you live for seven years after giving them, although there have been rumours that this could be upped to 10 years at some point.

Starting to give gifts out of regular income is another option, Cook says. People can give away as much money as they want as long it comes out of their regular income – such as employment or pension income rather than capital – and doesn’t diminish the giver’s standard of living in any way, explains Alice Haine, a personal finance analyst at the platform Bestinvest.

Give me an example of how the new rules might work.

Let’s say Emily, 73, died with a defined contribution pension worth £700,000, plus other assets worth £800,000. She didn’t leave a surviving spouse or civil partner. Emily didn’t use her pension during her retirement as she relied on other assets and savings. After her death, her pension fund will pass to beneficiaries chosen by the pension scheme.

Currently, her estate is valued at £800,000 for IHT purposes, as her pension is excluded. After applying the £325,000 tax-free threshold, her estate owes £190,000 in IHT (40% of £475,000).

From April 2027, Emily’s pension will be included in her estate, increasing its value to £1.5m. The IHT bill shoots up to £470,000 (40% of £1.175m). Of that £470,000 bill, £219,333 would come out of the unused pension cash before it is paid out to Emily’s beneficiaries.