Why gold prices are surging to record highs

Gold prices have been hitting record highs. Pictured are gold bullion bars in Birmingham, England on Dec. 13, 2023.

Christopher Furlong/Getty Images/Getty Images Europe

hide caption

toggle caption

Christopher Furlong/Getty Images/Getty Images Europe

President Trump’s chaotic tariff policies continue to rock U.S. stock markets, which just ended their worst quarter in years. But for some investors, all of this uncertainty has a big gold lining.

The price of gold has been hitting all-time highs this week, as investors snap up something that’s often seen as a safe haven. Early Tuesday, gold futures hit a new record price of $3,177 per ounce, before falling back a little. But they are still up more than 18% from the start of the year — while the S&P 500 is down more than 4% over the same period.

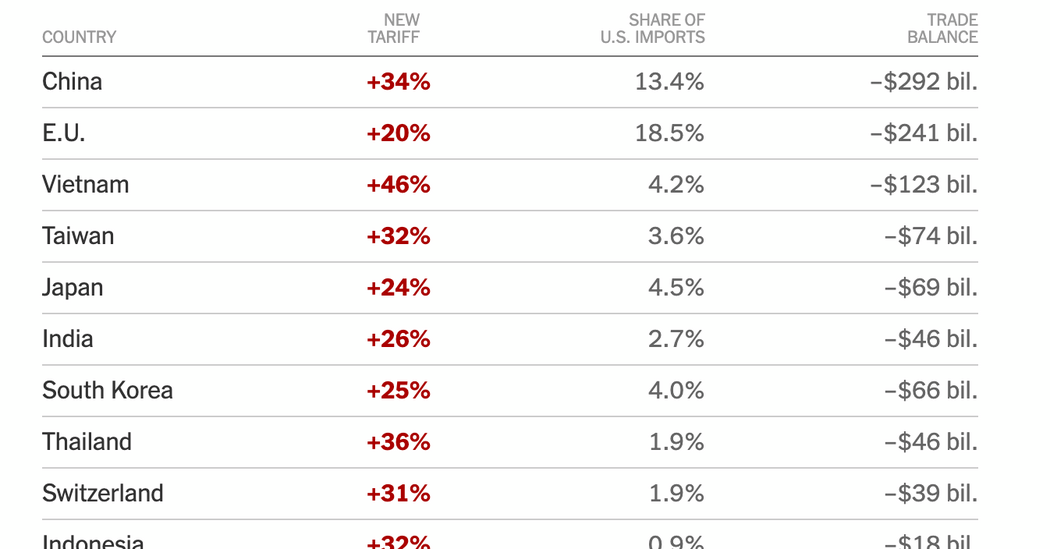

The gold frenzy comes as markets around the world continue to panic over Trump’s tariffs, which are widely expected to increase prices for consumers. The trade war has also created massive uncertainty for businesses and investors. It’s also fueling global tensions between the United States and its largest trading partners — and stoking fears about the increasing probability of a U.S. recession.

The president has promised to roll out even more tariffs on Wednesday, which he’s calling “Liberation Day.” But the steep taxes he has already imposed — as well as the on-again, off-again way he has announced them — have already shaken investors, businesses, economists, and consumers.

Amid all this uncertainty, here are three things to know about the surge in the price of gold.

Gold prices have been turbocharged by tariffs

The price of gold has been gradually rising for years, but it’s really hit a hot streak since the beginning of 2025.

Some analysts expect the price to keep climbing. Michael Widmer, head of metals research at Bank of America, last week published a report projecting that the price of gold would soar to $3,500 per ounce over the next 18 months.

In an interview with NPR, Widmer said that many factors have contributed to the years-long run-up in gold prices — but the recent surge has been “almost exclusively driven” by tariffs-related fears and uncertainty.

“It’s those tensions — the uncertainty about economic policies or the policy uncertainty — that have really been supportive for the gold market,” he says.

Gold may be known as a “safe haven” — but it can be volatile

Despite its current years-long rally, Widmer cautions that gold can be volatile. (As investors have recently seen with both stocks and the price of Bitcoin, what goes up can always come back down.)

Yet gold has long enjoyed a reputation for offering safety in what’s known as the “fear trade.” As a glittering precious metal that can be held (and hoarded!), gold offers the appearance of safety and solidity next to stocks and other (often less-material) financial instruments.

“When it seems like the world is going to hell in a handbasket, gold usually appreciates,” says Lee Baker, a certified financial planner who is the founder and CEO of Claris Financial Advisors in Atlanta.

Gold prices have surged, but stock markets have tumbled as investors worry about Trump’s tariffs.

Michael M. Santiago/Getty Images/Getty Images North America

hide caption

toggle caption

Michael M. Santiago/Getty Images/Getty Images North America

But rushing out and buying gold might not be right for everyone

Baker warns there can be downsides to buying and owning gold — even in times of crisis. For example, unlike stocks or bonds, gold doesn’t pay any dividends or interest. So the only way to make money from this investment is to buy some, and then hope to sell it after the price goes up.

There are also physical and logistical challenges to investing in gold — especially for people who want to buy the real thing. For example, buyers need to consider how to store it — and whether to pay for the security and insurance required to keep precious metals in their homes.

For those who are gold-curious but perhaps not ready to adopt a doomsday-prepper lifestyle, Baker notes that it’s possible to invest in gold-backed funds that don’t require physical ownership of precious metals.

Still, “if you’re buying gold right now just because you’re caught up in the buzz, because it’s going up — I’d probably say leave it alone,” he says. “Because it’s likely to lead to some form of disappointment.”

More broadly, Baker says the current gold frenzy highlights a larger lesson about investing in more than just one asset class, such as stocks.

“Your mama told you not to put all your eggs in one basket. It applies to investing as well,” he says. “Diversification matters.”